- Home

- Sustainability

- Information Disclosure Based on the TCFD Recommendations

In December 2021, Harima Chemicals Group announced its support for the "TCFD (Task Force on Climate-related Financial Disclosures)" recommendations. In March 2022, it also endorsed the purposes of the GX League*, and has been participating to its full-scale operation since May 2023.

| *GX League: | Established in March 2022 as a platform for discussions to transform economic/social system involving stakeholders and for practical initiatives for creating new market, embracing carbon neutrality as a growth opportunity. |

Harima is outlining its information disclosure policy on "Governance," "Strategy," "Risk Management," and "Metrics and Targets" based on the TCFD recommendations.

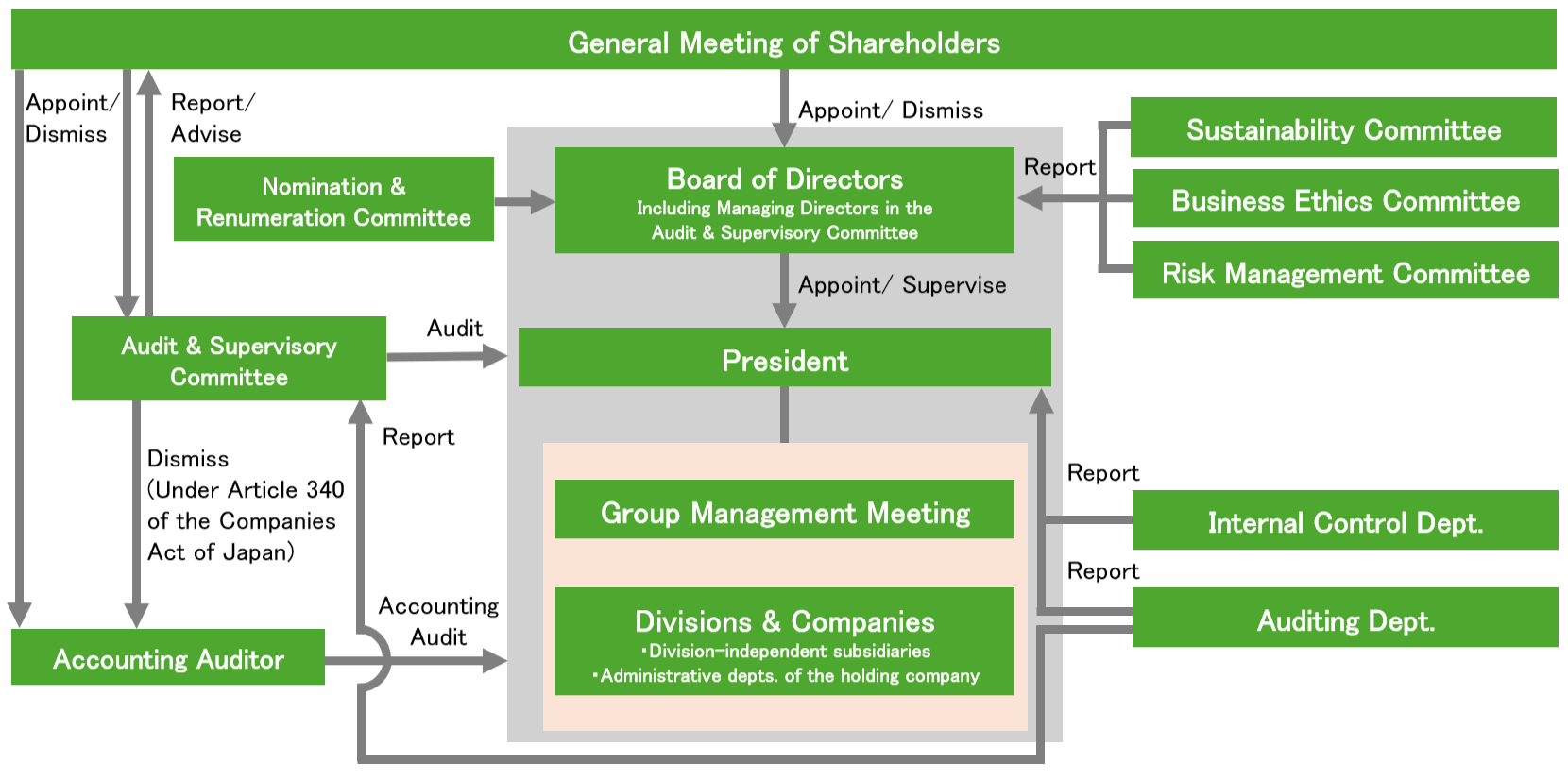

Key management matters related to sustainability including climate change, are reported to the Board of Directors by the Sustainability Committee. While taking into consideration the risks and opportunities across the business, the Board deliberates on, decides and oversees specific measures and execution plans that drive forward Harima’s sustainable growth and contribute to addressing social issues.

The monthly Group Management Meeting, attended by Managing Directors, Operating Officers and Directors of divisions and departments, covers such topics as progress of business execution, identification and evaluation of risks and issues pertaining to the business environment and their appropriate countermeasures. The meeting is also an opportunity for business divisions to share any sustainability-related issues they face, for which senior management provides necessary instructions.

Recent years have seen an increase in the demand for tall oil pitch, also outlined as an advanced biofuel in the EU Renewable Energy Directive (RED II), as well as replacement of fossil fuels. As the only producer of tall oil rosin and fatty acids in Japan, Harima continues to play a vital role in providing the market with stable supply of tall oil-derived chemicals for a wide array of applications.

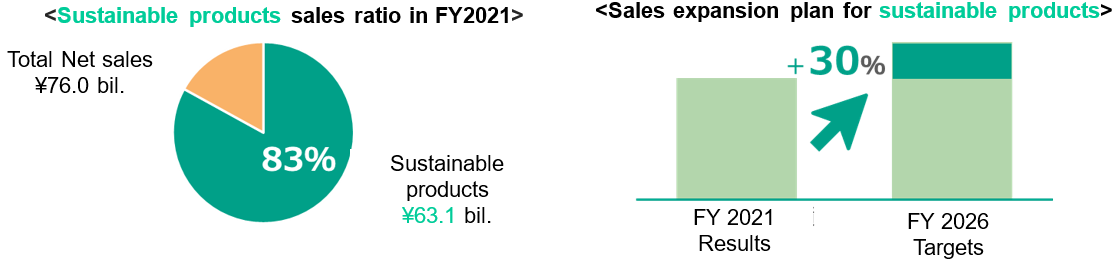

Our mid-term plan stipulates expanding the lineup of sustainable products that ease environmental load and deliver value to society by promoting renewable sources and recycling, as well as reducing the use of harmful substances, VOC and plastic.

As a company that utilizes the blessings of nature to enhance the quality of life, Harima employs a circular business model that makes effective use of natural resources. This ensures that the business is highly compatible with the target of achieving a sustainable society. We will continue to explore the potential of the pine chemicals business, striving to develop new applications and strengthen business fundamentals, as we aim to establish a leading position at global level.

Our products originate from crude tall oil, a raw material derived from the kraft-pulping process of pine trees. While this is distilled to obtain such substances as rosin and fatty acids, any surplus generated throughout production is utilized as biomass fuel.

Our legacy dates back to 1958 when we began operations as the first company in Japan to specialize in crude tall oil (CTO) refinery, further extending our value in 1973 by establishing the world's first closed-loop tall oil distillation plant. Harima has long been involved in emission reduction, through its wide portfolio of environmentally friendly products that use rosin obtained from pine trees, together with opening a biomass power facility at Kakogawa Plant (Japan) in 2005 and a solar-power generation facility with a capacity of 1,129kW at Iho (Takasago city, Japan) in 2014. We started use of carbon-neutral liquified natural gas (LNG) in 2022 and launched our first floating solar-power generation business on a reservoir in 2023 in collaboration with the local administration and residents, reiterating Harima's long-standing commitment to protect the environment, give back to the community, and enhance business all at the same time. Additionally, in 2023, we opened a myrcene production facility at Kakogawa Plant, powered primarily with self-generated energy from renewable resources and carbon-neutral fuel, making it truly sustainable. Moreover, at Kakogawa Plant, we introduced a system that pairs utilization of electricity with a non-fossil fuel energy certificate which serves as proof that electricity originates from renewable energy sources, eliminating carbon dioxide emissions from electricity use. These emission mitigation initiatives will be gradually employed at our other plants as well, towards achieving carbon-neutral operations by 2050.

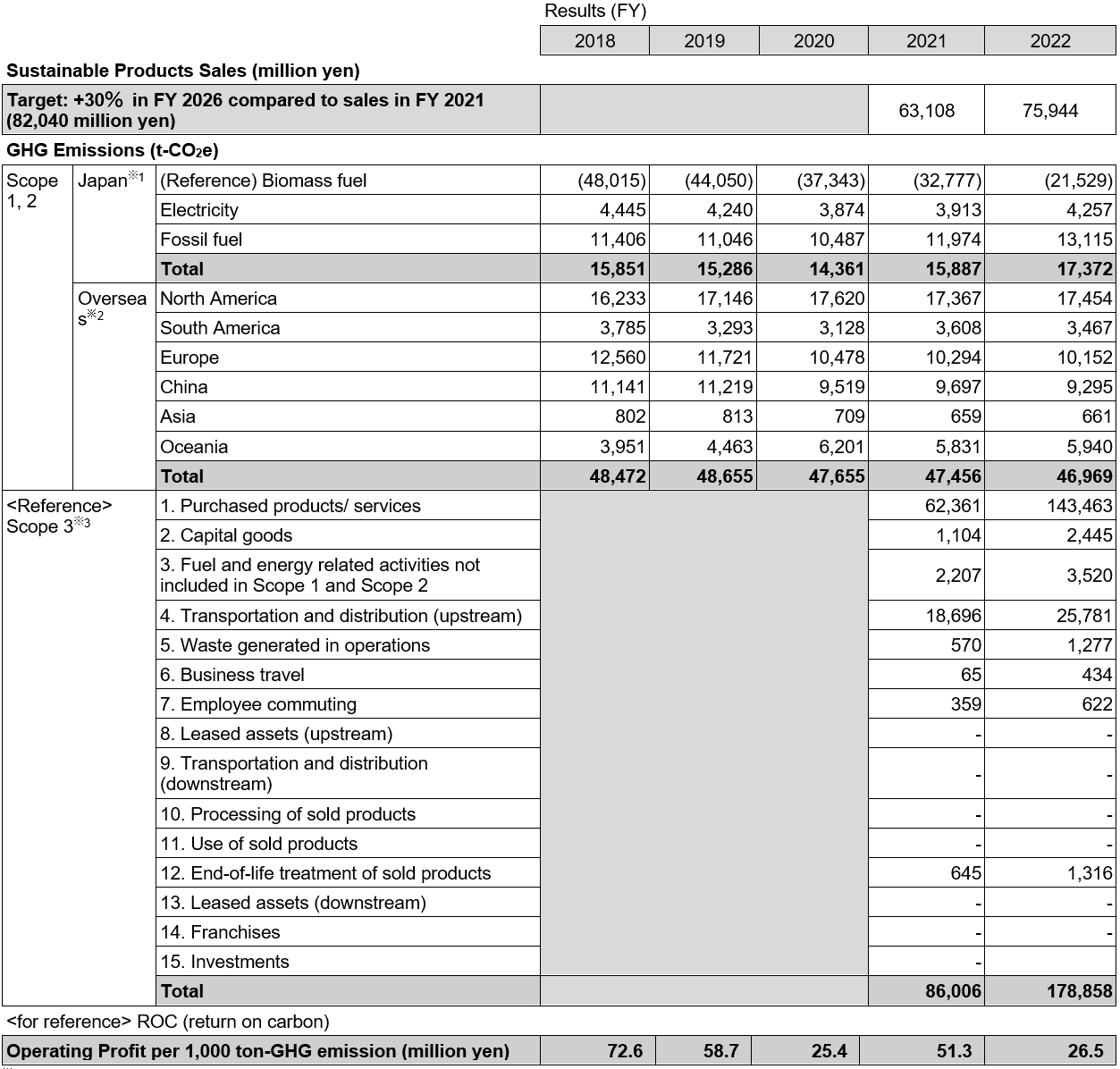

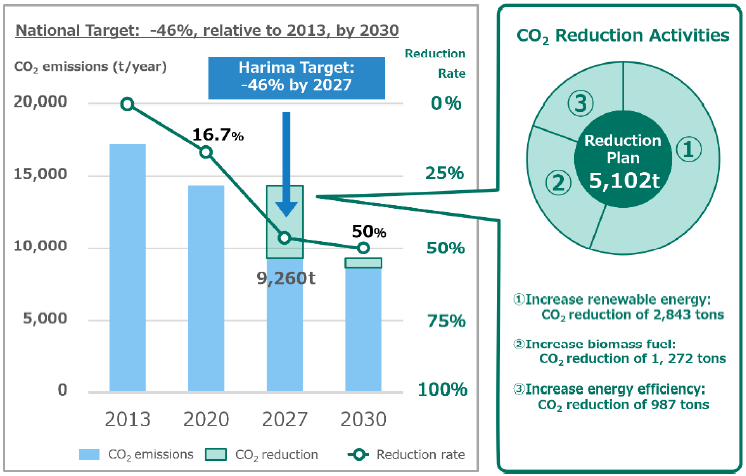

In June 2021, Harima announced its latest environmental protection policy which stipulates a reduction of 46% in the quantity of its greenhouse gas (GHG) emissions by 2027, and of 50% by 2030. This is 3 years ahead of Japan’s national target that requires enterprises to mitigate emissions by 46%, relative to 2013 levels, by 2030. In order to achieve this target, we will continue efforts to reduce environmental impact through transition to natural gas and initiatives to reduce energy use.

The status of these strategies is regularly revised and disclosed, as described in “Metrics and Targets” below.

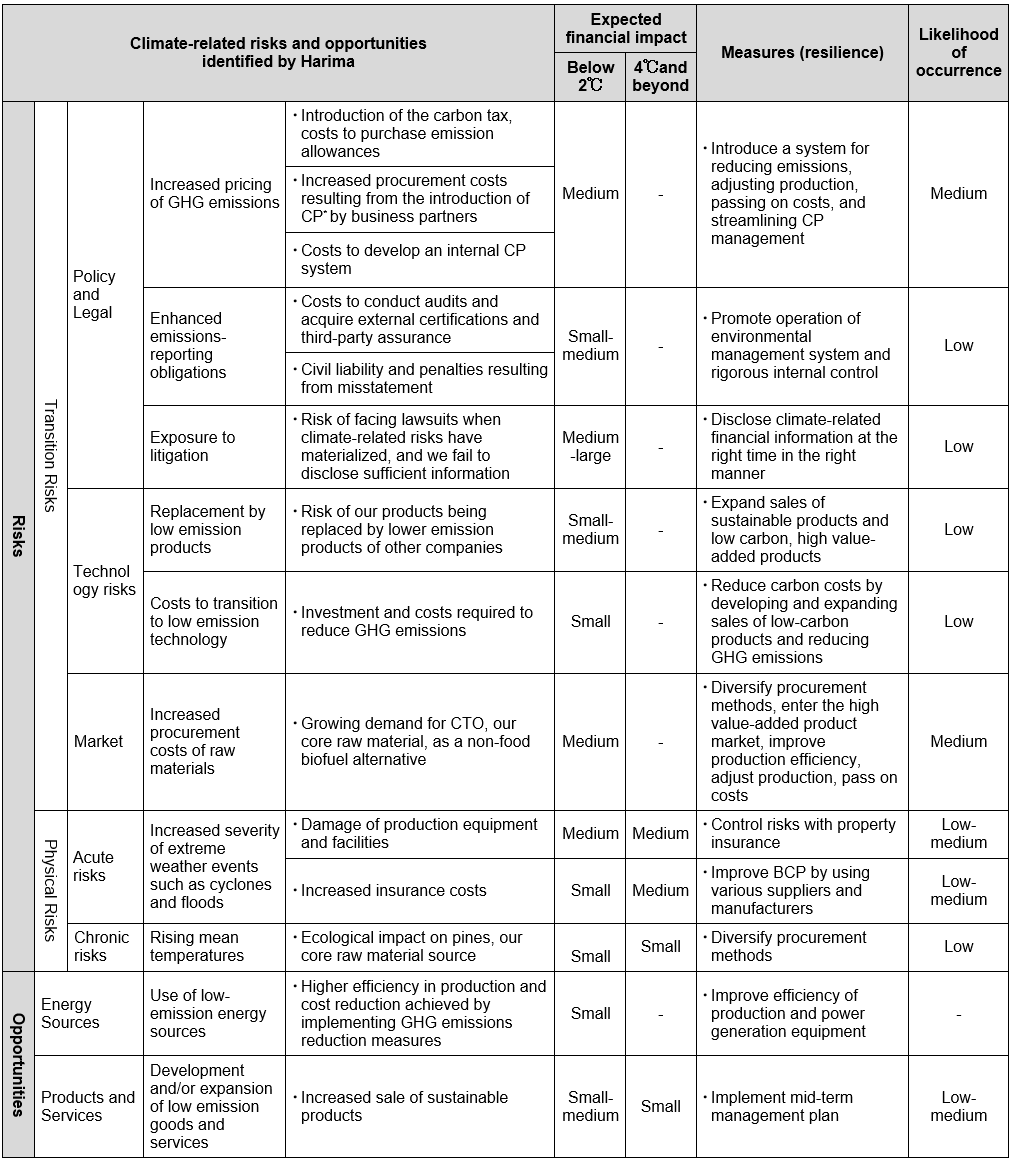

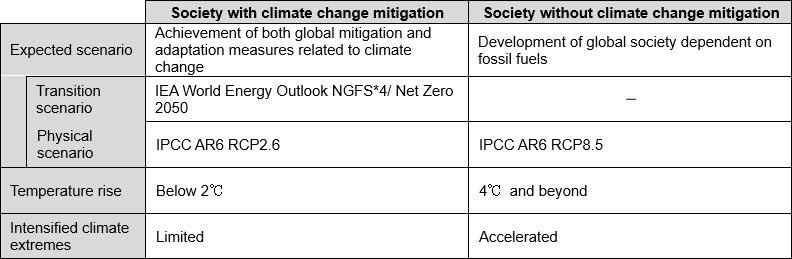

As for the actual and potential impacts of climate-related risks and opportunities on our business, strategies and financial plan, we have identified climate-related risks and opportunities that may have a material financial impact for the scenarios for temperature rise of below 2℃ and of 4℃ and beyond respectively using the risk management process described below. Based on correct risk assessment, we take necessary measures to further build our resilience.

Harima’s business operations are conducted in line with our policy of continuously enhancing corporate value for all stakeholders, including shareholders, customers, employees, business partners, and local communities. To ensure practical and transparent business management paired with timely decision-making, we are committed to strengthening the functions of the Board of Directors, Audit & Supervisory Committee, Auditing Department and Internal Control systems, while also improving our frameworks for disclosure, compliance and risk management.

The metrics to assess climate-related risks and opportunities based on the afore-mentioned Strategy and Risk Management are shown below. We started monitoring Scope 3 emissions in FY 2022 besides efforts towards GHG emissions reduction targets (Scope 1, 2.). We will keep working towards achieving each target.